🔍 Fundamental Analysis

1. Macro Context and Expectations

This week, US job openings (JOLTS) fell to 7.192M, well below expectations. Consumer confidence also dropped, both against the previous month and forecasts.

On Wednesday, April 30, Q1 GDP came in at -0.3%, missing the +0.2% forecast and sharply down from +2.4% the previous quarter. Mixed PCE inflation data failed to weigh down the USD.

Thursday will bring ISM Manufacturing PMI, expected to decline, and a rise in jobless claims.

On Friday, May 2, the market awaits April Non-Farm Payrolls (NFP), forecast at 129,000 vs. March’s 228,000, with unemployment steady at 4.2% and hourly wages at +0.3%.

Overall, weaker US macro data continues to pressure the USD, which has lost its safe-haven status so far this year.

2. NFP Scenarios and Market Reactions: USD & US500

If NFP comes in below 129,000, the USD will likely weaken further, especially if unemployment rises or wage growth confirms a bearish bias. This scenario could boost the US500 as it increases pressure on the Fed to start easing rates.

Large speculators have also increased their net short positions on the USD, reaching the highest level in six months according to the latest COT data—potentially amplifying the dollar’s downside.

On the flip side, an NFP print above 129,000 would support the USD by pushing back concerns about labor market softness, and increase the likelihood of higher-for-longer Fed policy. In this case, US500 could retrace after its recent gains, as markets would begin pricing out monetary stimulus.

3. Underlying Trend: COT, Volume & Open Interest (OI) in EURUSD

As of April 25, speculative net longs in EURUSD dropped from 69.3K to 65.0K, indicating a reduction in bullish positions.

In the Euro FX futures market, open interest hit 719,232 contracts during the week of April 22, its highest level in a year, reflecting strong market participation.

Between Monday, April 28 (1.1422) and Tuesday, April 29 (1.1391), EURUSD fell 0.27%, showing bearish pressure in a high OI environment. The combination of falling prices and rising open interest suggests fresh short positioning, reinforcing the EUR’s short-term weakness against the USD.

📉 Technical Analysis

DXY Index (H4)

The USD maintains a bearish structure as long as it trades below the key H4 resistance at 100.19. A break below the current demand zone at 99.18 may trigger further selling toward the next buy-side liquidity at 98.33, where bulls could re-engage and push the price back to 100.00. Failure to bounce could extend the bearish trend toward 98.00 and 97.46.

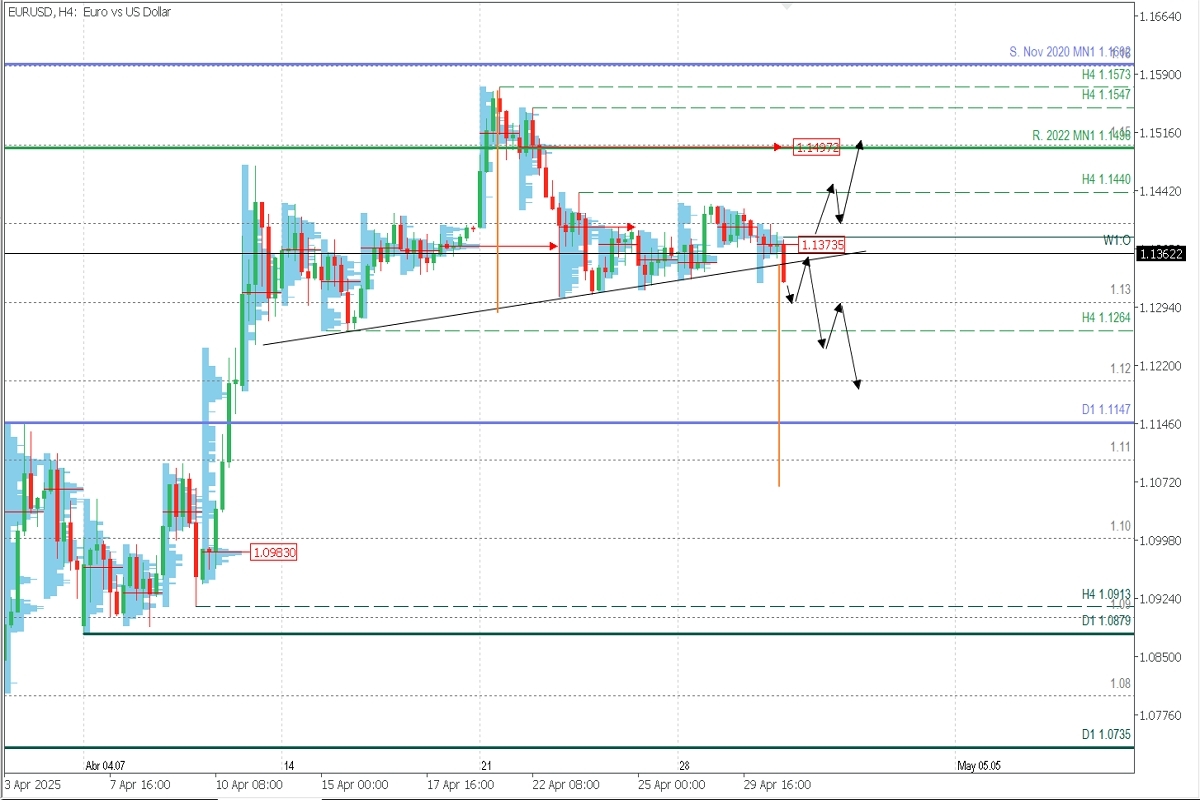

EURUSD (H4)

Supply zones: 1.1373 / 1.1497

Demand zones: 1.1264 / 1.1200

Price is consolidating within a possible head-and-shoulders reversal pattern that has yet to fully activate due to recent consolidation. The session’s volume has concentrated around 1.1373, a potential sell zone where bearish interest may hold as resistance.

A confirmed neckline break suggests a continuation to the downside, with targets at 1.1300, 1.1264, and 1.1200—roughly 50% of the pattern’s projected move.

However, a bullish reversal cannot be ruled out. If price breaks above 1.1440, the structure would be invalidated, opening a path to 1.1500 as the next liquidity zone.

Technical Summary

Bearish Setup: Sell below 1.1373, targeting 1.1300, 1.1264, and 1.1200 in the short term.

Bullish Setup: Buy above 1.1400, targeting 1.1440 and 1.1500.

Exhaustion/Reversal Pattern (ERP)

Before entering trades at key zones, always wait for the formation and confirmation of an ERP pattern on the M5 timeframe as shown here 👉 https://t.me/spanishfbs/2258

Uncovered POC (Point of Control)

The POC is the level with the highest volume concentration. If a bearish move followed this zone, it’s considered a sell area and acts as resistance. If a bullish move followed, it’s a buy zone and acts as support—usually located near lows.